Next Generation insurance

built for Senior Living

Powered by real-operational expertise & real-time intelligence.

We deliver smarter, faster, data-driven underwriting built specifically for senior-living risks.

A modern insurance experience powered by real operational insight, competitive pricing, and human responsiveness, supported by more than 15+ years of senior-living underwriting expertise.

We deliver smarter, faster, data-driven underwriting built specifically for senior-living risks.

A modern insurance experience powered by real operational insight, competitive pricing, and human responsiveness, supported by more than 15+ years of senior-living underwriting expertise.

Why brokers are choosing Tricura

Expertise built from inside senior living.

Our leadership and underwriting teams possess operational backgrounds in senior living.

Our teams include individuals from a variety of departments and diverse professional backgrounds, including clinical, operational, financial, and legal disciplines.

The decisions they make are informed by the nuance of their experience, shaping their perspective and understanding of what is truly important within the underwriting process.

Fast answers move deals forward.

Speed matters when brokers are managing active accounts, renewals, and client expectations.

At Tricura, submissions are reviewed quickly and questions are addressed directly—without unnecessary handoffs or delays. Your accounts don’t sit in long queues waiting for attention.

Our underwriting process is designed to maintain momentum. That means better clarity, quicker responses, and a smoother experience from submission to quote.

Get a Quote

Competitive Pricing — Powered by Real Data

Through our partnership with Gemini Analytics, Tricura brings real-time operational insight into our approach to risk control. By analyzing how facilities actually operate—not just what’s on an application—we gain a clearer, more accurate view of risk.

This added precision allows us to drive a lower cost of risk with greater confidence and consistency. Instead of relying solely on static data, we incorporate real-world signals that help differentiate accounts and avoid broad assumptions.

The result is smarter operational decisions and stronger, more competitive pricing for brokers and their clients—especially in a market where accuracy matters more than ever.

Coverage that meets the market—without compromise.

Tricura offers primary limits of $1M / $3M with aggregate options up to $10M.

Our coverage form is comprehensive and structured to compete with top carriers in the senior-living space. It’s designed to meet broker and operator expectations without overcomplicating the process.

This approach ensures consistency, flexibility, and alignment with real-world facility needs—making it easier to place coverage with confidence.

Get a Quote

Smarter insurance begins

with smarter data

Meet Gemini Analytics

Through a partnership with Gemini Analytics, Tricura brings real-time operational insight into the risk mitigation process—analyzing how senior living facilities actually operate, not just what appears on an application.

44% fewer fines Facilities using Gemini saw a significant drop in CMS fines.

40% reduction in penalties Cleaner documentation and automated audits improve compliance.

21% fewer complaints Real-time operational oversight leads to better resident outcomes.

After coverage is bound, Gemini is deployed with the operator to help reduce exposure, identify operational gaps, and surface risk factors that increase liability.

By incorporating real-world operational signals instead of relying solely on static data, Tricura gains a clearer and more accurate view of risk—supporting stronger risk control and a lower overall cost of risk with greater confidence and consistency.

Facilities also demonstrated improved operational stability, including reduced nursing turnover and stronger QM ratings across the cohort.

Smarter insurance begins

with smarter data

Meet Gemini Analytics

Through a partnership with Gemini Analytics, Tricura brings real-time operational insight into the risk mitigation process—analyzing how senior living facilities actually operate, not just what appears on an application.

44% fewer fines Facilities using Gemini saw a significant drop in CMS fines.

40% reduction in penalties Cleaner documentation and automated audits improve compliance.

21% fewer complaints Real-time operational oversight leads to better resident outcomes.

After coverage is bound, Gemini is deployed with the operator to help reduce exposure, identify operational gaps, and surface risk factors that increase liability.

By incorporating real-world operational signals instead of relying solely on static data, Tricura gains a clearer and more accurate view of risk—supporting stronger risk control and a lower overall cost of risk with greater confidence and consistency.

Facilities also demonstrated improved operational stability, including reduced nursing turnover and stronger QM ratings across the cohort.

Coverage availability deeper.

Engineered for the complexities of senior living risk.

Coverage that goes deeper.

Engineered for the complexities of senior living risk.

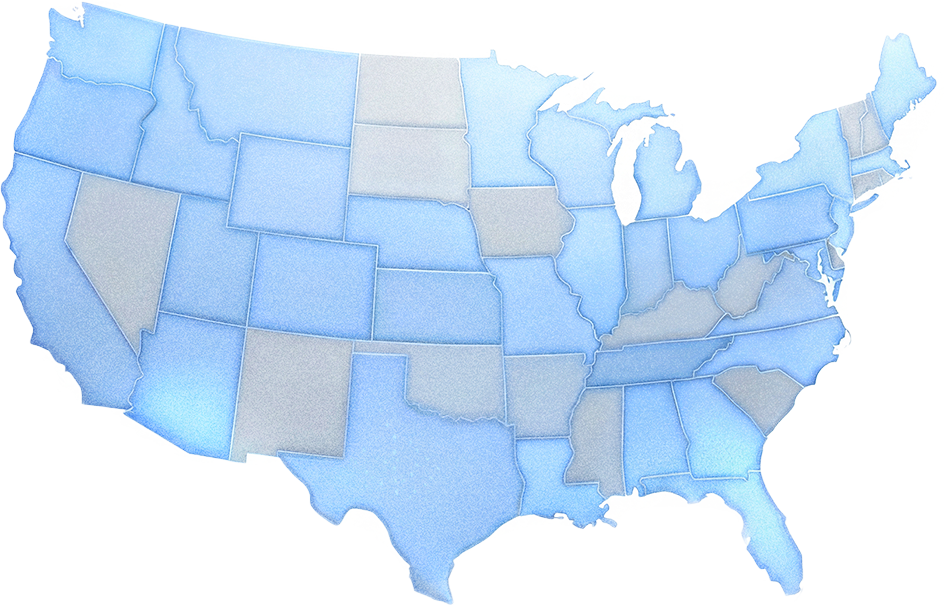

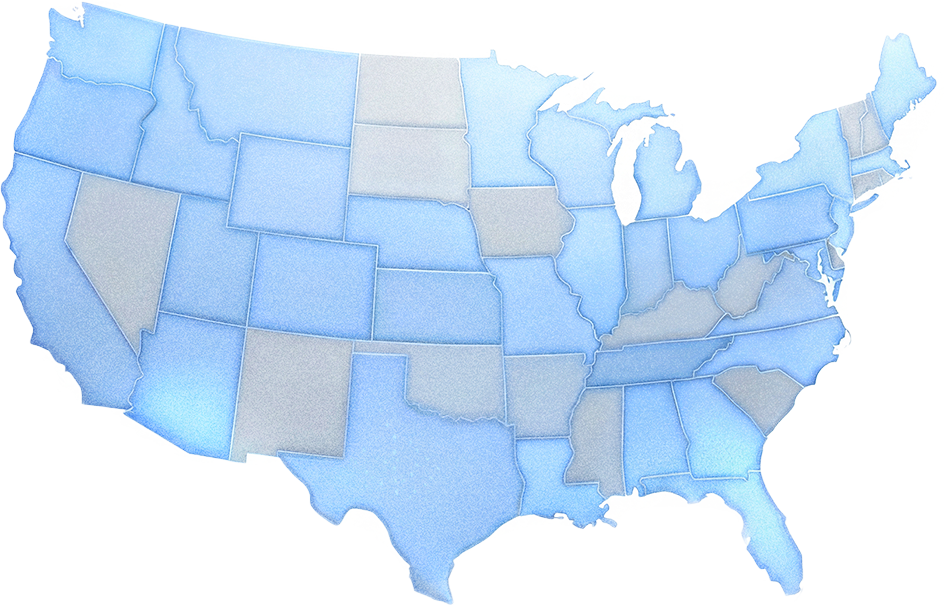

Coverage availability

Get started in 3 simples steps

1. Connect with us

A short introduction to our underwriting team.

2. Meet the team

A quick call to align on appetite, coverage, and next steps.

3. Start submitting

Get appointed and begin sending submissions directly.

Get in touch.

No automated replies.

Just experienced underwriters ready to support your business.